- A partner’s current account was prepared from the following information

|

Partner’s salary |

Shs1,200,000 |

|

Drawings |

Shs800,000 |

|

Share of profits |

Shs500,000 |

|

Interest on drawings |

Shs700,000 |

Calculate the current account closing balance

- Shs200,000Cr

- Shs500,000Dr

- Shs600,000Cr

- Shs800,000Dr.

2.What entries should be made to correct an error where purchase of goods for Shs3,ooo,000 was recorded as Shs300,000 in the creditor’s account.

- Dr. Creditor’s Account Shs3,000,000, Cr. Purchases Account Shs300,000

- Dr. Creditor’s Account Shs2,700,000. Cr. Suspense Account Shs2,700,000

- Dr. Purchases Account Shs2,700,000, Cr. Suspense Account Shs300,000

- Dr. Suspense Account Shs2,700,000, Cr. Creditor’s Account Shs2,700,000

3. Which accounting concept states that a business is expected to operate in the near future?

- Historical cost

- Going – concern

- Consistency

- Objectivity

4.Identify a current liability from the following items

- Commission receivable

- Interest receivable

- Subscriptions due from staff

- Salaries due

5. Determine the value to be paid by a customer for goods costing Shs5,000,000 at 5% trade discount and 2% cash discount.

- Shs4,655,000

- Shs4,650,000

- Shs4,750,000

- Shs4,900,000

6. A credit balance in the bank column of a cash book is known as

- cash at bank

- bank draft

- bank overdraft

- contra balance

7. What makes a three Column Cash Book different from a Two Column Cash Book?

- Folio columns

- Cash columns

- Discount columns

- Bank columns

8. Which of the following items appears on the debit side of a trial balance?

- Purchases

- Sales

- Returns outwards

- Capital

9. The statements below are true about single entry book keeping except

- Opening Capital + Net Profit – Drawings = Closing capital

- Assets + Liabilities + Capital

- C. Cash Sales + Credit sales = Total Sales

- Business goods + Business cash used by the owner = Drawings

10. Given;

Prepaid rent Shs600,000

Accured rent Shs200,000

Rent Paid Shs900,000

Determine rent amount to be transferred to the profit and loss account.

- Shs300,000

- Shs1,700,000

- Shs1,300,000

- Shs500,000

11.The purpose of preparing a worksheet is to

- make end of year adjustments in the final accounts

- check the arithmetic accuracy in the trial balance

- reconcile the trial balance with the ledger

12.Which of the following items is debited to the trading account?

- Sales

- Returns outwards

- Purchases

- Closing stock

13.Which of the following items would make a bank statement have higher balance than a customer’s cashbook balance?

- Bank charges

- Uncredited cheque

- Unpresented cheques

- Ledger fees

14.How does a cheque payment to creditors affect a balance sheet?

- Cash at bank and creditors increase

- Cash at bank reduces and creditors increase

- Creditors reduce and cash at bank increases

- cash at bank and creditors reduce

15.The following statements are correct about accured rent receivable except that it is

- a credit balance

- income received in advance

- income earned but not yet received

- credit to the profit and loss account.

16.The cost of equipment is Shs5,000,000 and its depreciation per year is Shs400,000. Determine the net book value of the equipment at the end of 5 years.

- Shs3,000,000

- Shs2,000,000

- Shs5,400,000

- Shs4,600,000

17.What entries are made when a partnership makes a loss?

- Dr. Appropriation Account, Cr. Partners Current Account.

- Dr. Profit and Loss Account, Cr. Appropriation Account.

- Dr. Appropriation Account, Cr. Profit and Loss Account.

- Dr. Partners Account, Cr. Appropriation Account.

18.An example of revenue expenditure on premises is

- legal fees for purchases of premises

- purchase of premises

- re-painting of premises

- extension of premises

19. The sum of all Value Added Tax (VAT) charges on purchase invoices for a given period is known as

- customs tax

- input tax

- excise tax

- output tax

20. Choose a correct statement from the following:

- Credit purchases are credited to creditor’s control account

- Discount allowed are debited to debtor’s control account

- Bad debts written off are credited to debtor’s control account

- Returns outwards are credited to creditor’s control account.

21. State the items in a profit-making organization that are similar to each of the following in a non-profit-making organization:

- Receipts and Payments Account

- Income Statement

- Surplus

- Deficit

- Accumulated fund

b)The following balances were extracted from the books of Batoto Football Club as at 30th June 2016:

|

Shs |

|

|

Equipment |

15,500,000 |

|

Bank overdraft |

2,000,000 |

|

Furniture &fittings |

10,800,000, |

|

Creditors |

7,200,000 |

Required: Prepare the Club’s Statement of Affairs as at 1st July 2016.

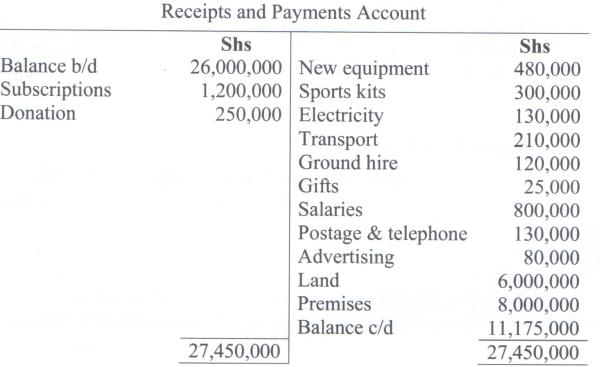

c) Below is a summary of receipts and payments of Yeffe Womens’s Club for the year ended 31st December 2016.

Additional Information

- Depreciate equipment and sports kits by 10% (on cost)

- Subscriptions due Shs 100,000

- Subscriptions prepaid Shs.60,000

- Electricity outstanding Shs30,000

- Transport paid in advance Shs10,000

Required

Prepare the Club’s Income and Expenditure Account for the year ended 31st December 2016.

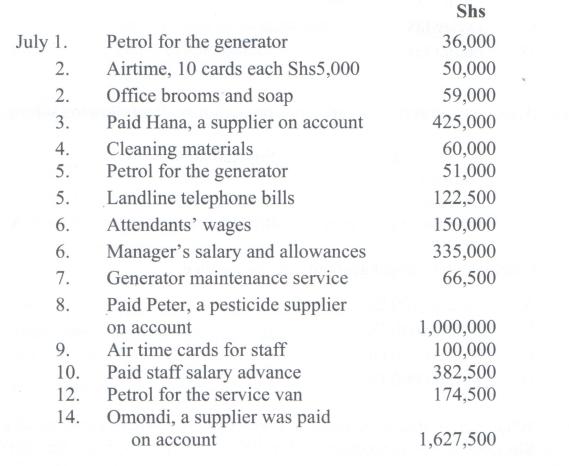

22. a) Give two advantages of maintaining a Petty Cash Book

b) Dudu Stock list Ltd are dealers in pesticides. They use an imprest sytem to maintain a petty cash book. The maximum petty cash float is Shs5,000,000 and re-imbursement is done after every two weeks.

On 1st July 2017, the Petty Cahier received the cash float Shs5,000,000 and made the following payments:

Required:

Prepare a petty Cash Book using Power & Fuel, Communication, Salary & Wages, Cleaning and Ledger account analysis columns.

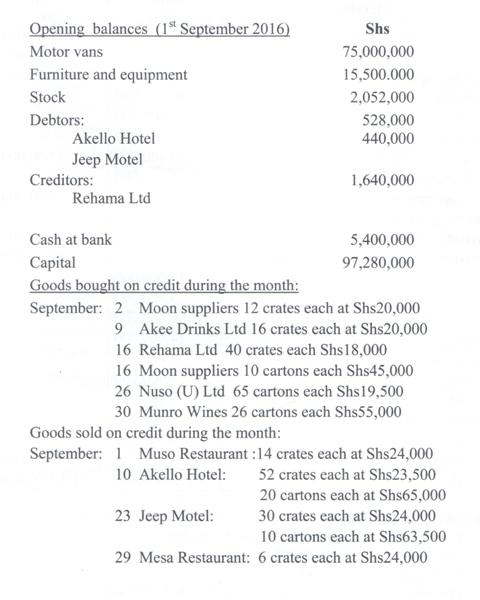

- Dan Okello, a dealer in soft drinks and spirits had the following transactions for the month ended 30th September 2016

Required:

Prepare;

a) General Journal

b) Purchase Journal

c) Sales Journal.

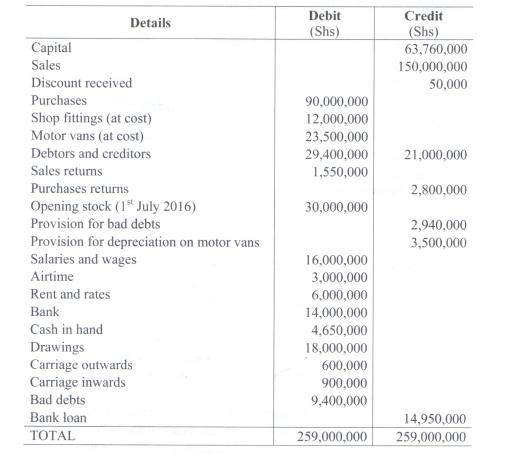

23. The Trial Balance below relates to B. Tabaro for the year ended 30th June 2017:

Additional information;

- Closing stock (30th June 2017) Shs35,000,000

- Accrued wages Shs9,000,000

- Prepaid rent Shs1,000,000

- Provision for bad debts to be increased to Shs3,500,000

- Depreciate shop fittings by 5% per annum and motor vans by 20% per annum on cost

Required:

Prepare;

- Trading, Profit and Loss Account for the year ended 30th June 2017

- Balance Sheet as at 30th June 2017.

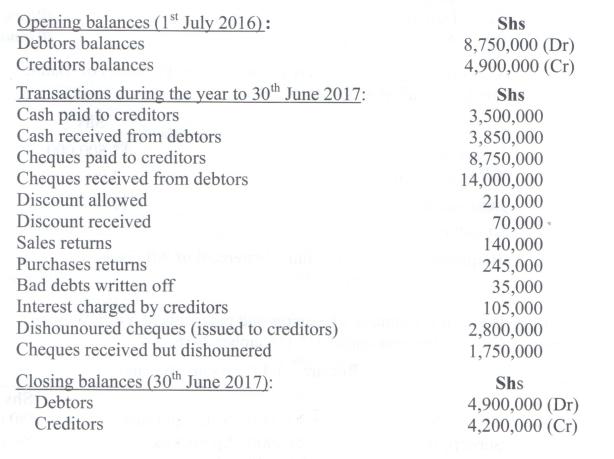

24. a) What is an inter-ledger transfer in relation to Control Accounts?

b) Bruno Securex deals in electricity security systems and appliances: The following balances were extracted from their journals:

Required: Prepare;

i) Sales Ledger Control Account to determine credit sales.

ii) Purchases Ledger Control Account to determine credit purchases

25. Give three difference between direct taxes and indirect taxes

- State any four types of indirect taxes

- Dorothy Nabiryo is an Accountant with Mega (U) Ltd. her employment contract has the following monthly provisions:

Basic Salary

400,000

Housing allowance

300,000

Medical allowance

30,000

House helper

100,000

Lunch allowance

150,000

Electricity & Water allowance

120,000

Required:

- Calculate Dorothy’s monthly taxable income

- Tax payable to URA per month using the PAYE Income tax brackets given below.

P.A.Y.E TAX RATES Chargeable Monthly income

Tax Rate

Not exceeding Shs235,000

Nil

Exceeding Shs235,000 but nit exceeding Shs335,000

10% of the amount by which chargeable income exceeds Shs235,000

Exceeding Shs335,000 but not exceeding Shs410,000

Shs10,000 plus 20% of the amount by which chargeable income exceeds Shs335,000

Exceeding Shs410,000

Shs25000 plus 30% of the amount by which chargeable income exceeds Shs410,000